Employee financial wellness: What employers need to know about creating a strategy that works

Financial wellness has become a very hot topic lately. We’ve been talking about it a lot, and sharing the financial wellness framework we developed with State Street Global Advisors, as we speak with companies that want to help their employees become more fiscally fit.

It’s become increasingly clear that a significant number of employees are struggling financially. And while many employers are ready and willing to come to the rescue with financial wellness benefits, their good intentions can fail to get off the ground unless they have a clear understanding of how money challenges affect almost everyone, how employees’ financial wellness actually benefits an organization—and use this information to inform their financial wellness strategy.

Employees of all income levels struggle financially

When we think about people struggling with their finances, we tend to think of lower-paid workers. But research shows that salary is only one component of financial wellness. In fact, more than three quarters of Americans—regardless of what they earn—describe themselves as living paycheck to paycheck. And the average American carries $15,000 in credit card debt.

So why are so many people—across the salary spectrum—challenged by the same issues? Much of it has to do with the way we view money. For most of us, having money for the here and now is our top priority. In fact, about one-third of people aren’t willing to cut back on their current lifestyle, even if it means having more money in the future.

Given our tendency to spend for today and worry about tomorrow, it’s not surprising that the majority of people (63%) don’t have a financial cushion for emergencies. That leaves a big chunk of any employee population on the verge of financial disaster.

That’s why financial wellness is such an important nut for employers to crack—because it’s not just workers who feel the effect. Employers feel financial stress in the form of lower productivity, missed work, and lower performance.

- 24% of employees say personal financial issues are a distraction at work.

- 29% of defined contribution participants report missing work to deal with the emotional stress caused by their finances.

- 40% of employees say they spend more than 3 hours each week dealing with personal finance issues.

And of course, all of this impacts your company’s quality, products, customers, sales, earnings, culture—you name it. In other words, employees’ financial health has considerable influence on the organization’s health.

Meet employees where they are

Employers have an incredible opportunity to help alleviate employees’ financial pressures—and experience the ripple effect on the business—because they can provide access to solutions in an efficient and affordable way.

And employees are hungry for this kind of help. Almost 90% believe that their company should help them become financially prepared for the future. To do this, employers first need to identify the diverse financial needs of their equally diverse employee population.

There are lots of ways to get a handle on what employees are struggling with. Start by listening to what the data’s telling you (e.g., which pages on your benefits website are getting the most traffic? What search terms are employees using? Are benefits claims spiking in any areas? Is your EAP getting more calls than usual?). Analyze the feedback on your website. And make a point to get employee feedback—informally or more formally through surveys and/or focus groups. Walk a mile in their shoes to understand what they need to be successful.

An employer program should be flexible enough to meet the needs of those living paycheck to paycheck to the highest paid members of the workforce—and everyone in between. It’s common to have a combination of financial “personalities” within any workforce:

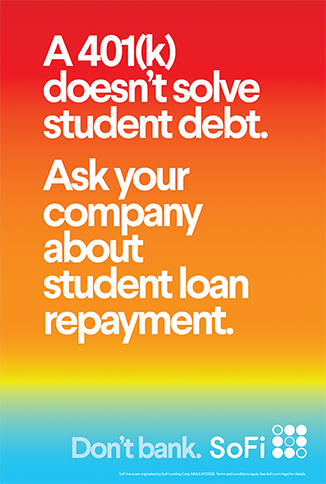

This SoFi Lending Corp. bus poster speaks directly to that message, reminding employers that their standard 401(k) isn’t the sort of financial support employees with student debt are looking for at that point in their life.

Once you understand what employees need—and your goals for the financial wellness program—you can explore the variety of emerging solutions. For example, debt repayment programs are becoming increasingly popular. One of them—low-cost loans to employees—recently made headlines in The Wall Street Journal.

To help you better understand the financial segmentation of your workforce, borrow this page from the financial wellness framework we created with State Street Global Advisors.

Common financial segmentation within any workforce

Income struggles

- Often the lowest-paid members of the workforce, living paycheck to paycheck.

- May work more than one job, trying to make ends meet.

- Limited financial resources and knowledge of finances leaves them at risk for predatory lending practices, which can cause poor credit.

Spending challenges

- Live paycheck to paycheck.

- Claim to be financially literate, but generally don’t manage cash effectively.

- Unlikely to have a budget, and are likely have poor credit.

- Credit card and other debt eat into their ability to create a savings cushion for emergencies.

Building savings

- Has savings cushion.

- Understands the importance of saving and is preparing for the future.

- Needs help fine-tuning budgeting and cash-flow management skills.

- Looks for ways to save on taxes.

- Wants to get the most out of workplace benefits.

- May still need financial literacy and education support, with an emphasis on basic investing.

Extra income

- Among the top 20% of earners in a workplace.

- Financially literate and thinking about the future.

- Owns a home or is likely in a position to buy one.

- Has children and is saving for college.

- Thinks about—and takes steps toward—building retirement savings.

- Looks for ways to save on taxes.

- Needs support with wealth management and investment decisions.

Financially secure

- Among a company’s most well compensated.

- Looks for ways to maximize tax benefits.

- Is very interested in financial planning and wealth building.

- Has planned for unforeseen circumstances.

- Has prepared legal documentation, including a will, and has named a power of attorney and account beneficiaries.

- May not fully understand the value of the total compensation package.

- Prioritizes saving in retirement accounts, saving at maximum IRS contribution levels.

- May need assistance with additional retirement planning strategies.

For best practice tips to bring financial wellness to your organization, check out our financial wellness framework. Or, contact us to help.

Work with Us

We partner with organizations that value their people first. Let’s talk.

Rita Harris, VP Senior Consultant, is known for her ability to break down complex benefits programs into their essential parts, so employees can quickly assess “what’s in it for me.”