5 Behavioral Nudges That Boost Retirement Planning Engagement

We often think that more is better, especially when it comes to choices. However, as the character Manny Delgado from Modern Family once said, “too many choices is a prison.” While he was talking about what to wear, choice overload is a well-documented concept in behavioral science because it often hinders decision-making. It’s the reason why people delay or give up on making a choice or take the path of least resistance—doing nothing. It’s also why we second guess, wonder “what might have been,” and sometimes make sub-optimal choices.

Studies suggest that adults make up to 35,000 decisions a day. As you might imagine, decision fatigue affects every aspect of our lives—from the less consequential decisions about what we stream to the more impactful choices about what to eat and how much to save for the future. It’s just one of the many reasons why retirement planning, in particular, is so challenging.

The good news is that plan sponsors have been building this knowledge into their retirement plan design for many years. It's why automatic enrollment, auto escalation, and professionally managed default investment options have become mainstay features in most defined contributions plans, which are helping more people, at all income levels, save for their futures. It’s also why plans have consolidated their recordkeepers and reduced the number of investment options to simplify the participant experience and to limit choice.

But that’s not all that plan sponsors can do. They can also make retirement plan designs more navigable, including organizing their menu of investment options into tiers—which often include a do-it-for-me option like a target date fund or managed account—and white labeling fund options, framing them around objectives like “seeks to help your savings grow” or “seeks to help you preserve your savings.”

Yet despite all these improvements to plan design, 46% of Americans are at risk of not having enough saved for retirement. So, what else can you do to help prepare your people for their futures? Here are 5 strategies informed by behavioral science that can help you reduce complexity, build confidence, and consequently, boost your participants’ engagement.

Prime

Like getting a wall ready for a fresh coat of paint, priming refers to getting your people ready to receive important information. This is why campaigns are so effective at focusing attention on a particular call to action—like joining a one-month savings challenge, reviewing new investment choices, or adding a beneficiary. Through multimedia campaigns, you can help raise awareness that a change is coming or action is required. Then, as the campaign progresses, you can shift focus to help participants understand how taking action will benefit them.

Novelty is another way you can catch people’s attention and inspire them to take action. You can do this by using clever headlines, bold graphics, or unexpected channels, such as a video message from a CEO, mirror clings at the office, or campaign-branded coffee sleeves.

Catch people’s attention and inspire them to take action with unexpected channels, such as campaign-branded coffee sleeves.

Repeat

One of the founders of behavioral economics, Daniel Kahneman, has observed that “repetition induces cognitive ease and a comforting feeling of familiarity.”1 Coined the “mere exposure effect”2 by Robert Zajonc, the more often we see something, the more favorably we view it. These insights have important implications for financial planning—the more we engage with it, the more comfortable we become with it. This in turn builds our financial literacy and confidence over time. Relevant, bite-sized, just-in-time messages remind people of important features of your retirement plan—and other financial benefits—that they can take advantage of. You can build repetition into your campaigns by sending the same messages through different formats and channels, but you can also continuously and consistently remind people of the value of your retirement benefits and financial planning resources. With so many competing priorities, emails, messages, and tasks vying for attention, it takes multiple messages to ensure your communications cut through the clutter so that people take notice.

Make the Abstract More Concrete

Another way you can help employees make sense of choice is by illustrating the consequences of action (or inaction). In essence, you’re trying to make something that’s abstract feel more tangible in the present. For example, if a choice is optional (such as enrolling in a retirement plan):

| You can… |

|---|

| Ask people to enroll (opt in) |

| Auto-enroll them (with the option to opt out) |

| Give them either choice (opt in or out) |

| Illustrate the benefits of enrolling and the consequences of not enrolling |

The last approach, referred to as enhanced active choice, makes it clear which option will lead to a better outcome. In this example, the choice to enroll (or not) would include a statement such as “Yes, I want to enroll and live comfortably in retirement” or “No, I don’t want to enroll and I want to work forever.”

Sample showing the consequence of not enrolling in retirement plan.

The consequence of not enrolling is spelled out explicitly for participants. People “are given the choice along with an explanation of costs built into the question itself.”3 Consumer marketers use this approach all the time. To get people to sign up for email promotions, they might entice you with 10% off your next order. When you click no, it says something like “No, I don’t want to save 10% on my next purchase.” The consequences of opting in (or out) should factually state what you stand to gain (or lose).

Highlight Loss

By highlighting what participants may miss out on, you tap into another powerful motivator: loss aversion. We feel losses much more powerfully than we do gains. In retirement communications, researchers have found that cautionary framing is more effective in motivating participants’ behavior. It doesn’t matter how old someone is or what their gender is; everyone responds similarly to messages warning us that we might not be as prepared for retirement as we think we are. Researchers have found that “in the presence of greater uncertainty, people apparently spend more time processing ... information and, when they are engaging in more extensive processing, they tend to pay more attention to information that is framed negatively.”4 In your communications, your goals should be to show participants what’s at stake, without, however, confusing them or stressing them out—especially during uncertain times like a global pandemic, where stress levels are already elevated.

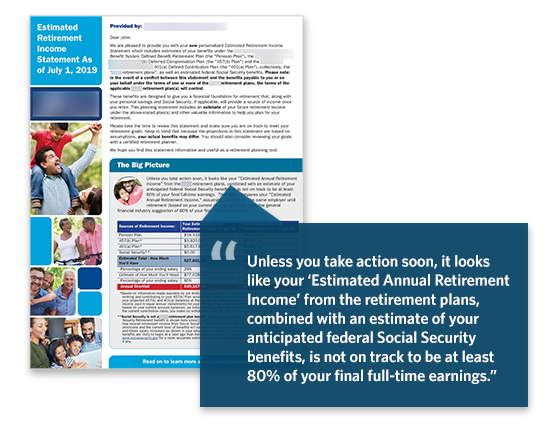

Anchor

Another way to more vividly illustrate the impact of savings rates on future income is to provide retirement income statements (which is now a requirement as a result of the Setting Every Community Up for Retirement Enhancement (SECURE) Act) or total rewards statements. By illustrating projected income, these statements intend to help people better understand how much income their balance may potentially provide them in retirement. This changes the anchor fixed in people’s minds from their total balance to the paycheck they could receive in the future, making that hypothetical figure more tangible, based on something they’re already familiar with—monthly income.

Sample of an anchor setting expectations for what employees need to do to enroll.

Anchors play a powerful role in steering our behaviors. They set expectations for what we need to do, such as how much we need to save. And participants may be taking cues from your plan design features without even realizing it. For example, participants may believe they’re saving enough for retirement if they’re contributing the same percentage as the employer contribution. You can reset anchors by explicitly highlighting rules of thumb offered by financial advisors, as done in this example:

Sample of an anchor setting expectations for what employees need to do to enroll.

In all your retirement communications and engagement efforts, keep in mind that cognitive and behavioral biases thwart the best of intentions—for everyone. Applying insights from behavioral science can help people navigate choice, feel more confident about their decisions, and be better positioned to live comfortably in retirement.

We're proud to work with organizations that value their people. If you want to learn more, we’d love to talk.

Sources:

Sheena Iyengar, How to Make Choosing Easier, TED Talk, 2011.

Daniel Kahneman, Thinking, Fast and Slow, Farrar, Straus, and Giroux, 2013.

Richard H. Thaler and Cass R. Sunstein, Nudge, Penguin Books, 2008.

1 Daniel Kahneman, Thinking, Fast and Slow, Farrar, Straus, and Giroux, 2011.

2Ibid.

3 “The Science of Better Choices,” Tuck School of Business at Dartmouth, Dartmouth College, 2021. tuck.dartmouth.edu/news/articles/the-science-of-better-choices

4 Julie R. Agnew, Lisa R. Anderson, Jeffrey R. Gerlach, and Lisa R. Szykman, “The Annuity Puzzle and Negative Framing,” Center for Retirement Research at Boston College, July 2008. crr.bc.edu/wp-content/uploads/2008/07/ib_8-10_508.pdf

Read Next

Work with Us

We partner with organizations that value their people first. Let’s talk.

Megan Yost, SVP Engagement Strategist, is a recognized thought leader in benefits communications, particularly in the areas of retirement, financial wellness, and employee engagement.