For Engagement, Promote Benefits at the Right Time via the Right Media

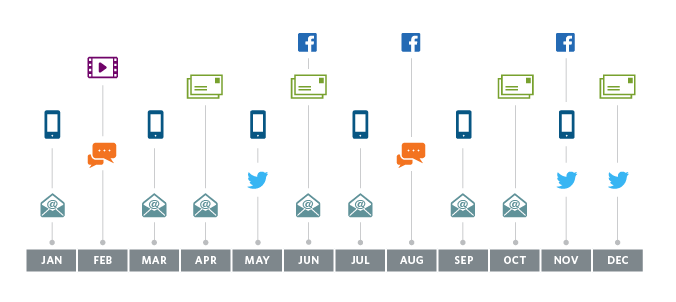

Reaching employees at the right time through the right medium

“La climatisation est indispensable ici.”

It’s one of the snippets of French that I still remember after years (years!) of studying the language in school. No one in my high school class could accurately pronounce this phrase—about air conditioning being indispensable—so our teacher made us repeat it over and over (and over again). French is no longer a part of my everyday life, and sadly, I’ve forgotten much of it. What my story demonstrates is the principle of use it or lose it—a critical concept as it relates to understanding our health and retirement benefits. Research confirms that we forget whatever we don’t practice regularly.1

More Skin in the Game than Ever Before

Until recently, employees heard about benefits from their employers only about once a year—usually during open enrollment. Yet, they were expected to remember how their benefits plans worked for the next 12 months. Now that we’re asking people to take a more active role in their health and finances, it’s not enough to remind them once a year to do all the things we want them to do.

Communication shouldn’t stop after a program is implemented, and it shouldn’t happen only once a year during enrollment. Frequent communication is essential for keeping benefits top of mind and reinforcing the employee value proposition.

That’s why multi-channel, year-round communication is key #6 in our ebook series, Unlocking Successful Benefits Communication: A 10-Key Framework Every Organization Needs to Get Results.

The Formula for Achieving Standout Results

One of our 100-Best-Companies-to-Work-For clients sets a flawless example for multi-channel, year-round communication. With the foundation of a strong strategy, brand, and benefits website, their benefits communication has evolved over the years to include frequent updates and campaigns delivered across many channels to reach both employees and family members. The channels they leverage include:

| Traditional Guides Newsletters Postcards Employee meetings Health fairs Posters Tip sheets |

Online and Interactive Intranet Benefits websites Social media Video Webinars Decision-support tools |

Unexpected Infographics eCards |

The result: exceptionally high engagement with benefits, from wellness and health care to retirement and financial programs.

In particular, the commitment to their wellness program communications has created remarkable results over a 5-year period:

- 68% of participants with high blood pressure significantly lowered their numbers.

- 34% of those with elevated glucose numbers moved to normal ranges.

- 56% in the high LDL (low-density lipoprotein) range moved to the normal range.

- 45% with high triglycerides significantly lowered their numbers.

This type of change doesn’t happen with one-and-done communication. Every January kicks off with a New Year campaign and health reminders. In the spring come onsite health fairs, with biometric screenings and open enrollment education. A big enrollment campaign in early summer focuses on engagement across all benefits (not just what’s changing). Communication continues through the summer and fall. In addition to robust information available on an external website and frequent home mailings to reach family members, campaigns are also promoted via email, manager tip sheets, intranet news articles, and onsite posters and signage. Also integrated are the wellness and health concierge mobile apps, which help drive people to the right programs.

This mix of different communications channels, along with frequent touchpoints, helps employees connect with benefits that are relevant to them at that moment.

Why This Approach Works

Humans are, well, human. To help us cope with the multitude of tasks we must perform every day, our brains develop shortcuts and rules of thumb.2 That’s why we apply psychology and behavioral science to the work we do—to help people overcome blind spots and biases we all share. Here’s just some of the science behind the success of our client’s year-round approach to benefits communication.

“Just in time” works best. No matter how many hours we spend learning something, we forget what we’ve studied unless we repeat the process. Recent research into financial literacy, for example, illustrates that education wears off significantly month after month, until our knowledge is back to where we started after just 18 to 24 months.3 That’s why it’s important to provide people with relevant information when they need to make a decision.

Status-quo bias. When it comes to our health and finances, it’s easiest to do what we’ve always done. In their seminal work, Nudge, Richard Thaler and Cass Sunstein point out that “many people will take whatever option requires the least effort, or the path of least resistance.”4 Getting employees to change a habit, behavior, or decision takes work and persistent nudging. If you want employees to engage with your programs when they actually need them, you’ll need to provide reminders and updates throughout the year. Consumer marketing research backs this up. So does recently published research by Facebook’s Marketing Science team, which concludes that “higher [communication] frequencies are required to impact greater behavior change.”5 While Facebook’s study was focused on digital communications, keep in mind that we all have different learning styles and preferences, so a mix of media will help ensure your messages resonate with different groups of employees.

Learn more about the importance of multi-channel, year-round communication, and read other case studies like this in our ebook series, Unlocking Successful Benefits Communication: A 10-Key Framework Every Organization Needs to Get Results. Multi-channel, year-round communication is part of Book II: Marketing. Don’t miss the other books in the series, which show you how to lay the foundation of your benefits communication and how to get the right resources in place.

We're proud to work with large employers who recognize the business value of engaging employees in benefits. If you want to learn more, contact us.

1 Daniel Fernandes, John G. Lynch, and Richard G. Netemeyer, "Financial Literacy, Financial Education and Downstream Financial Behaviors," Social Science Research Network, Jan. 6, 2014.

2 Richard H. Thaler and Cass R. Sunstein, Nudge, Penguin, 2008.

3 Daniel Fernandes, John G. Lynch, and Richard G. Netemeyer, "Financial Literacy, Financial Education and Downstream Financial Behaviors," Social Science Research Network, Jan. 6, 2014.

4 Richard H. Thaler and Cass R. Sunstein, Nudge, Penguin, 2008.

5 "Effective Frequency: Reaching Full Campaign Potential," Facebook IQ, July 2016.

Work with Us

We partner with organizations that value their people first. Let’s talk.

Megan Yost, SVP Engagement Strategist, is a recognized thought leader in benefits communications, particularly in the areas of retirement, financial wellness, and employee engagement.