Using Behavioral Science to Promote HSA Investing

Hitachi Vantara is a leading provider of cloud-based solutions to help companies get more from their data. Over the years, the company has worked hard to help its employees make the most of their triple-tax-advantaged Health Savings Accounts (HSAs). We’ve supported those efforts since 2014, first by helping Hitachi Vantara establish a strong communication foundation with a customized benefits brand and a comprehensive benefits website. Since then, we regularly reevaluate the company’s strategic goals and create focused campaigns designed to help employees take steps toward greater financial security.

Early HSA campaigns focused on encouraging employees to save enough in their HSAs to cover their health plan deductibles, in case they experienced an unplanned health event and found themselves with unexpected health expenses. Once employees achieved that milestone, they were nudged to save enough to reach the minimum balance needed to invest a portion of their HSAs for additional growth potential. Before that nudge, very few employees were taking advantage of that growth potential.

Through these communication efforts, the percentage of employees with HSA balances above $5,000 increased from 17.57% to 32.70%.

When Hitachi Vantara realized how many employees had HSA balances large enough to invest, the company decided to launch a targeted campaign to encourage its employees to start investing. They asked us to help.

Coming at the Problem from a Different Angle

Instead of merely promoting the potential growth benefits employees might gain by investing funds in their HSAs, we employed behavioral science in our approach to the campaign. When trying to encourage people to act, you have to both increase the motivation to act and reduce the barriers that prevent them from taking action.

We identified the following benefits to HSA investing:

- Tax-free interest on investment account earnings

- Typically, a higher average return than an uninvested account

- Automated—once you do it, set it and forget it

- Little monitoring required

Next, we identified the following barriers to HSA investing:

- Some do not have a high enough balance to invest

- People simply forget to do it

- Anything with investing can feel overwhelming

- General lack of knowledge about how investing works

Questions and concern around withdrawals from invested accounts

A Targeted Campaign Meets Barriers Head-On

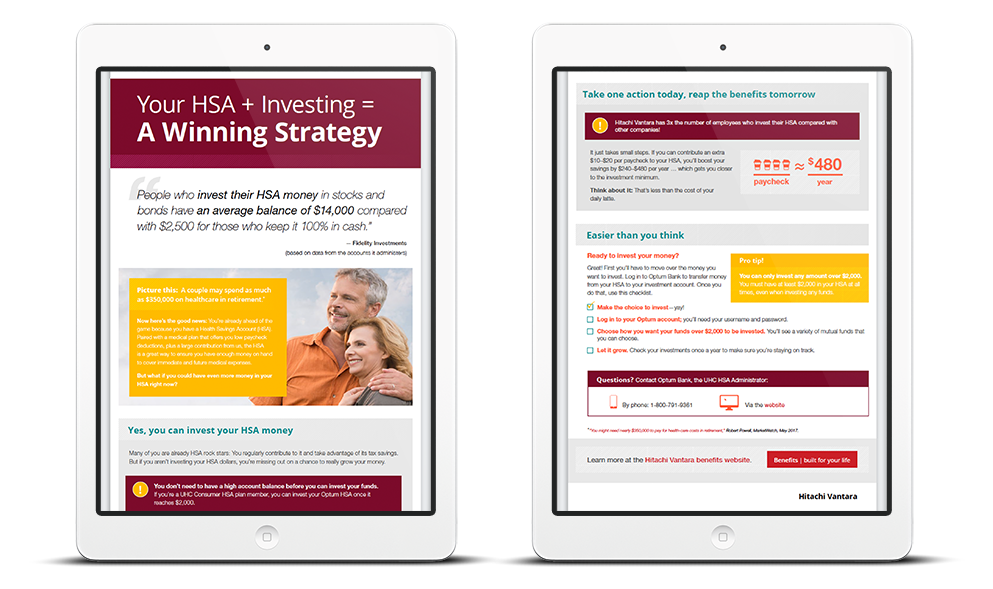

To address the range of employee concerns, we created a campaign that targeted employees based on their account balances. If they didn’t have enough money to start investing, they received an email and tip sheet about ways to increase their balances.

Employees who had HSA balances large enough to invest—but hadn’t invested—received an email and a custom-designed tip sheet that encouraged them to invest. The perceived complexity of investing was the biggest hurdle we had to overcome, so the campaign focused on simplicity. Compelling headlines like “It’s easier than you think” and step-by-step instructions were pivotal parts of these campaign pieces. Providing step-by-step instructions meant targeting the communications by administrator, as each had a different process for employees to follow.

The email also directed employees to the benefits website, where they could find additional HSA resources.

Measurable Results

The campaign was a resounding success. In its first month, one provider reported close to a 30% increase in the number of new HSA investment accounts.

See More Client Stories

The University of California’s new employee health plan exceeds enrollment goals with a smart brand, innovative design, and targeted campaigns.

Large multiemployer health and welfare fund captures attention when communicating significant benefit plan changes.

Expertise in change-management communication helps benefit leaders position plan changes to drive desired employee actions and achieve results.